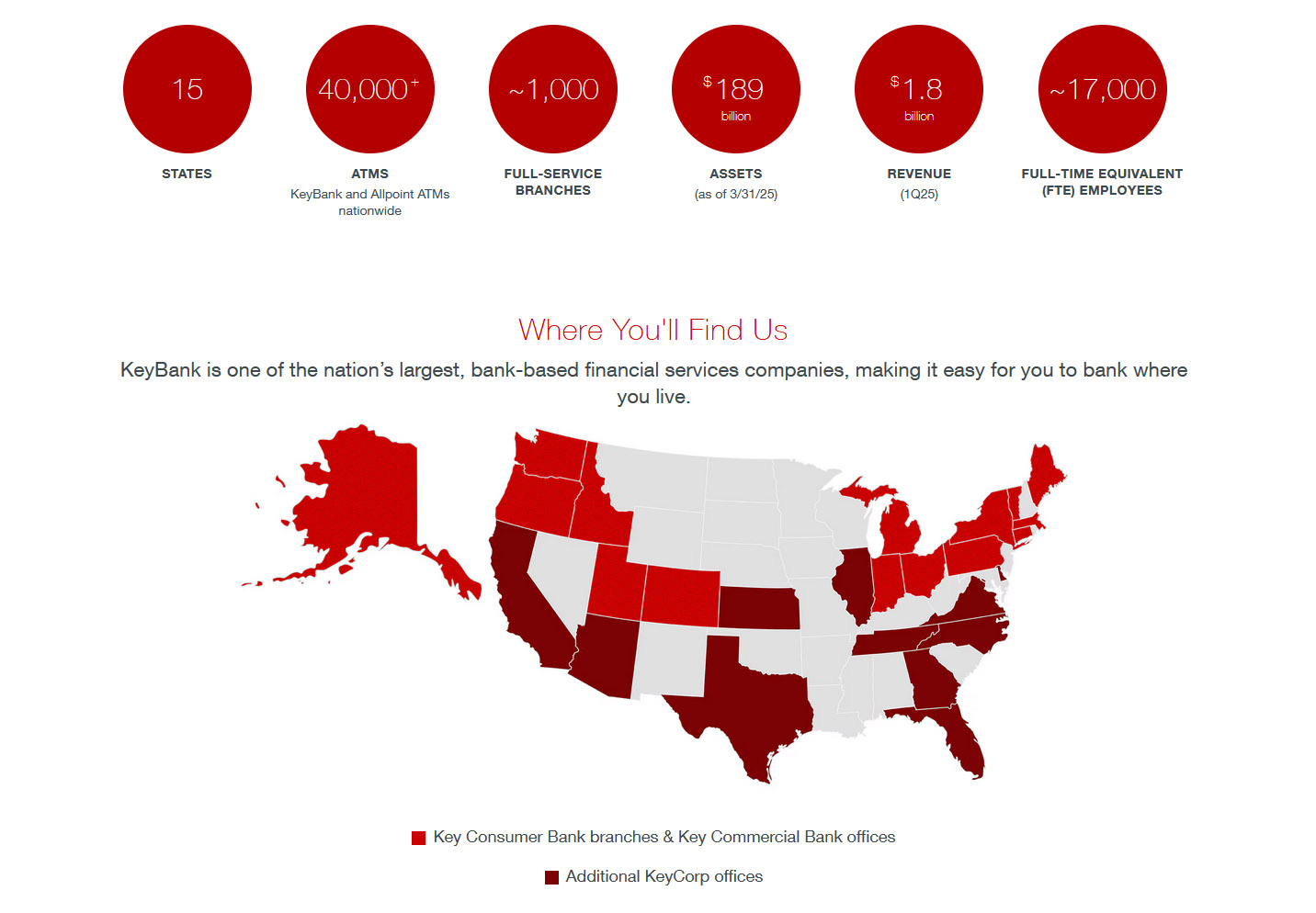

In 2025, KeyCorp celebrates its bicentennial, marking 200 years of service to clients and communities from Maine to Alaska. Headquartered in Cleveland, Ohio, Key is one of the nation’s largest bank-based financial services companies, with assets of approximately $189 billion at March 31, 2025.

Our management structure and basis of presentation is divided into two business segments, Consumer Bank and Commercial Bank.

The Consumer Bank serves individuals and small businesses throughout our 15-state branch footprint and through our national Laurel Road®1 digital lending business targeted toward healthcare professionals. We offer a variety of deposit and investment products2, personal finance and financial wellness services, lending, student loan refinancing, mortgage and home equity, credit card, treasury services, and business advisory services. In addition, wealth management and investment services are offered to assist nonprofit and high-net-worth clients with their banking, trust, portfolio management, charitable giving, and related needs.

The Commercial Bank consists of the Commercial and Institutional operating segments. The Commercial operating segment is a full-service, commercial banking platform that focuses primarily on serving the borrowing, cash management, and capital markets needs of middle market clients within Key’s 15-state branch footprint. The Institutional operating segment operates nationally in providing lending, equipment financing, and banking products and services to large corporate and institutional clients. The industry coverage and product teams have established expertise in the following sectors: Consumer, Energy, Healthcare, Industrial, Public Sector, Real Estate, and Technology. It is also a significant, national, commercial real estate lender and third-party master and special servicer of commercial mortgage loans. The operating segment includes the KeyBanc Capital Markets platform which provides a broad suite of capital markets products and services including syndicated finance, debt and equity underwriting, fixed income and equity sales and trading, derivatives, foreign exchange, mergers & acquisition and other advisory, and public finance.

Social Responsibility and Philanthropic Activities:

In addition to its contributions to financial education, KeyBank is deeply committed to social development and philanthropic efforts. In 2025, it plans to establish a charity dedicated to providing financial skills training to the unemployed, aiming to create new career opportunities and address high unemployment rates. Additionally, KeyBank will establish a charitable foundation in the UK to assist impoverished families and actively engage in projects related to education, health, and environmental conservation.

Outlook:

KeyBank is both a core platform for cultivating financial talent and a powerful catalyst for social progress. Its mission is to inspire members to achieve personal financial freedom through continuous innovation and a firm commitment to social responsibility, while actively contributing to social welfare.

Through a series of revolutionary educational and philanthropic initiatives, KeyBank aims to become a global incubator for aspiring financial professionals within the next two years, while also playing a vital role in promoting a better society.