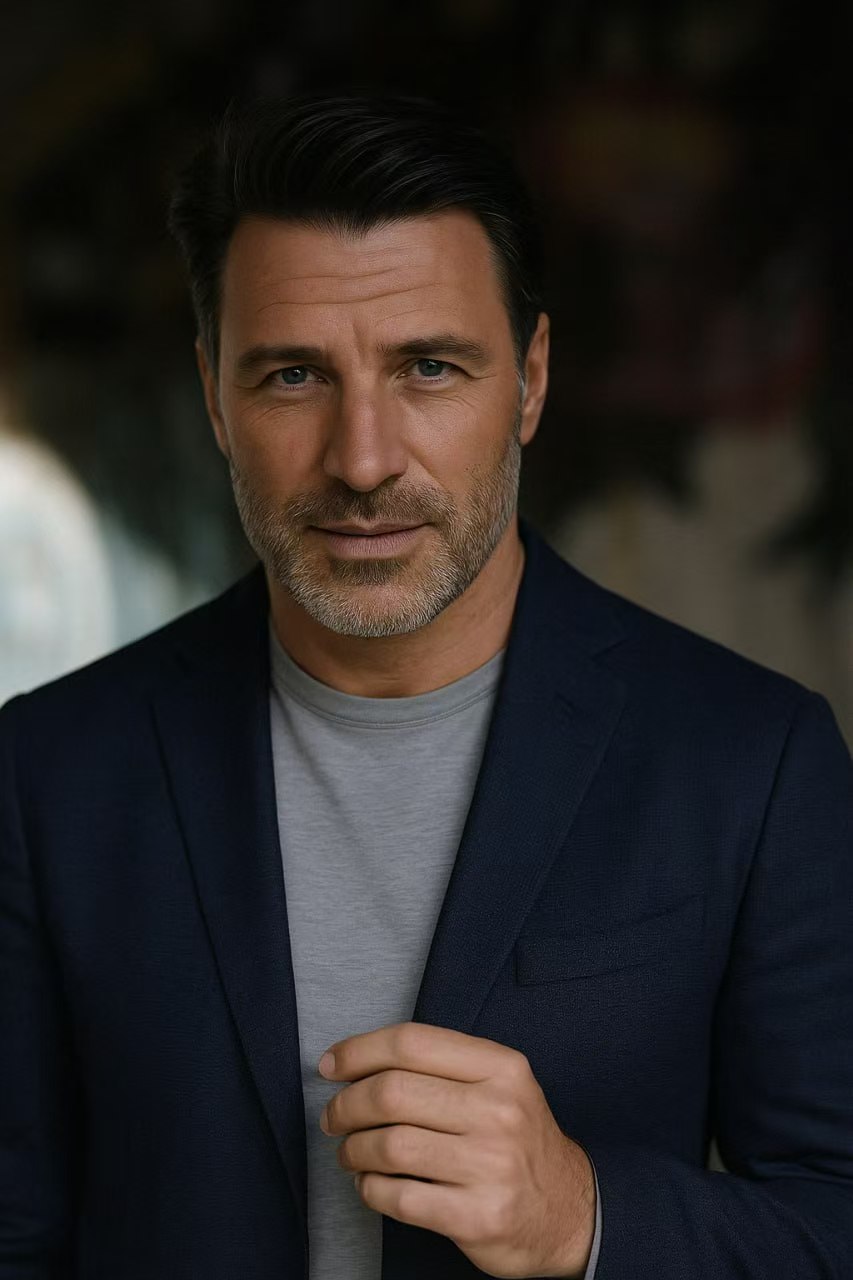

After graduating with a PhD, he started working at Morgan Stanley as a stock researcher. During his four years at Morgan Stanley, he delved deeply into the research of technology and energy stocks, accumulating valuable market analysis experience. Due to his outstanding performance in stock research, he was hired as a senior investment strategist by Key Bank. During this period, he led a team to develop an intelligent stock selection system that combined quantitative analysis and fundamental analysis, successfully improving the return on investment portfolios. With outstanding performance, he has held important positions at First Capital and was hired by the headquarters to be responsible for the development of the Italian market and the wealth accumulation of the Tianqiong Wealth Creation Plan. At the age of over 30, he utilized his professional knowledge in the stock market to make long-term investments in technology and energy stocks. After the 2008 financial crisis, he decisively bought undervalued high-quality companies such as Apple and Amazon, which brought him substantial returns. At the age of 40, he had already achieved financial freedom and has been committed to the development and innovation of stock selection systems. In recent years, he has further improved the AI stock selection model by combining AI, ensuring long-term stable profits. Riccardo Bellini is not only a financial genius’s growth history, but also an experienced stock professor who has a legendary experience of how to perceive trends, seize opportunities, and ultimately achieve financial freedom in the market. He provides the most accurate investment advice to Italian investors with his professional knowledge and practical experience, becoming a highly respected mentor in the market.